Investment approach

Overseen by our Investment Committee, the portfolio is constructed around the recommendations from our selected fund managers. We seek to create a relatively concentrated portfolio of between 25 and 30 Australian and internationally listed securities.

Our fund managers have strong performance track records and have very high conviction in the stock/s they recommend. We maintain a regular dialogue with each manager to ensure their conviction in the stock remains intact throughout the investment period. Should an investment thesis play out or change materially, the Company may closeout or replace the investment recommendation after consultation with the fund manager.

The unique blend of manager investment philosophies and styles aims to minimise the portfolio’s investment bias, and despite the relatively small number of securities (25-35), the portfolio has diversified exposure across geographic regions and industry sectors.

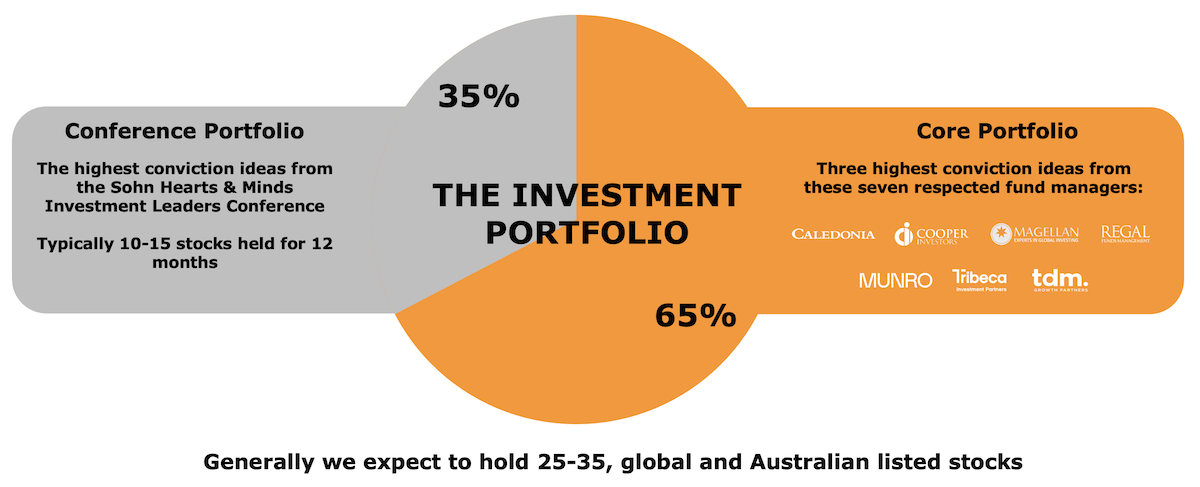

Hearts and Minds has two groups of fund managers who provide their highest conviction investment idea/s on a pro bono basis.

Group 1: Core Fund Managers - seven core fund managers each provide their three highest conviction investment ideas which are reviewed quarterly. These 21 securities represent 65% of the total portfolio.

Group 2: Conference Fund Managers - the remaining 35% of the portfolio is invested in at least ten securities based on the recommendations of the fund managers who present at the annual Sohn Hearts & Minds Investment Leaders Conference. Each year this group of fund managers will change based on the conference program of speakers and their eligible recommendations. The speakers are invited onto the program following a formal six-month selection process led by the conference founders/curators and the HM1 Board and Investment Committee.