Dividend Reinvestment Plan

The Dividend Reinvestment Plan (DRP or Plan) allows eligible Shareholders to acquire additional HM1 Shares when the Company makes dividend payments to its Shareholders. If the Company’s dividend payments are franked, participants in the Plan will receive these franking credits for their use, as well as receiving additional Shares in the Company.

The Board consider it important that the Plan operates to the advantage of all shareholders, not only those that participate in the Plan. Therefore, the Board will only operate the Plan where they have formed the view that the benefit derived from the capital raised through the Plan will exceed the costs associated with the Plan.

Shares issued under the Plan will be issued at a price equal to the volume weighted average market price of Shares sold on the ASX over the 4 trading days following the record date for the relevant dividend less any discount determined by the Directors at their discretion (rounded to the nearest cent).

How to participate

We invite Shareholders who would like to participate in the DRP to review the details of the Plan in the information booklet here. You can then complete and submit the DRP application form or variation form (DRP Form) to HM1’s share registry, Boardroom Pty Limited (Share Registry). Shareholders may do this online by logging into their account (or registering for an account) at http://www.investorserve.com.au/. The DRP election can be made under Payment Instructions > Reinvestments & Donations.

Alternatively, hard copy DRP Forms can be downloaded via the Share Registry at http://www.boardroomlimited.com.au/investor-forms/.

Enrolment in the Plan is voluntary, and the Company has designed the Plan to be straightforward and easy for eligible Shareholders to participate should they wish to do so.

Enquiries should be directed to the Share Registry on 1300 737 760 or +61 2 9290 9600

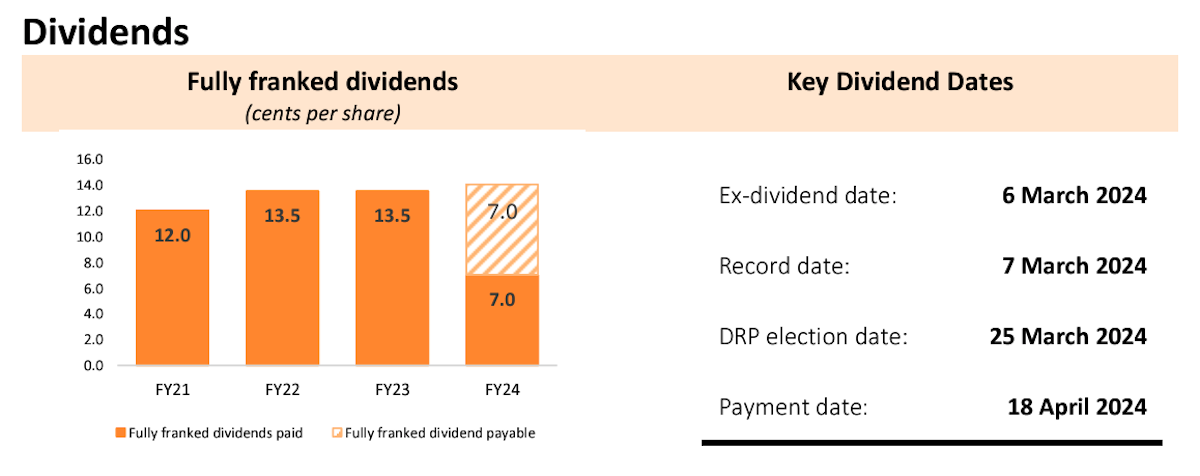

2024 Dividend

The Directors of HM1 are pleased to declare a fully franked interim dividend of 7 cents per share payable on 18 April 2024.

The Dividend Reinvestment Plan (DRP) will be in operation and participating shareholders can reinvest their cash dividend in new HM1 shares at the DRP issue price. The DRP issue price will be based on the market price of shares acquired under the on market acquisition provisions of the DRP. You can read the Results Announcement here.